Making a big impact on Financial Literacy

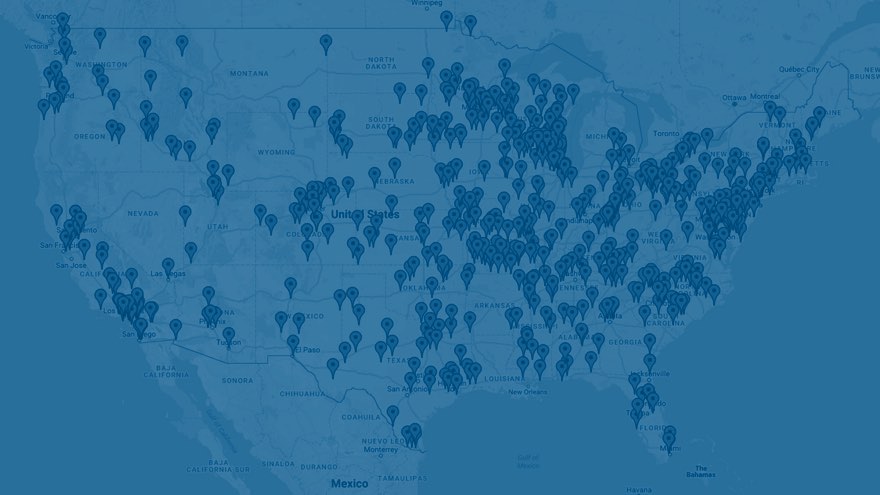

Discover's Pathway to Financial Success program has been making a big impact on financial literacy since 2012. Our program, devoted to bringing a financial education curriculum into public high schools across the country, had one simple goal: provide funding to teachers for financial education curriculum, materials and training so they can teach their students the skills they need to help them succeed and achieve brighter future.

We're proud to say...

Pathway has awarded more than $13 million in grants to nearly 1,900 schools and districts across the country

-

We helped more than one million students learn how to make good financial decisions and achieve their personal goals.

-

On average, students achieved a two letter grade test score improvement between pre and post course completion.